can you pay california state taxes in installments

The requested tax instalment payment is always equal to 14 of the tax owing at the end of the previous year. Western Union Pay online by phone or in person at one of their worldwide offices.

Can I Pay Taxes In Installments

There are certain limitations for eligibility for property tax assistance that apply if you are 62 years of age or older blind or disabled own and live independently and qualify for.

. Can you pay california state taxes in installments. Complete Edit or Print Tax Forms Instantly. The taxpayer is responsible for all tax bills S that must be paid along with expediting their payments under California lawIn case of secured property taxes you need to.

FTB is aware of multiple proposals from the Governor and Legislature to help Californians cope with rising prices of gas and other. Ad Access Tax Forms. It may take up to 60 days to process your request.

Western Union charges a fee for this service. So for example if your last income tax bill came to 3600 the. Important State gas price and other relief proposals.

Can I Pay California State Taxes In Installments. If you cant pay your tax bill in 90 days and want to get on a payment plan you can apply for an installment agreement. Like the IRS and many states the California Franchise Tax Board offers taxpayers the ability to pay taxes due over time.

The state typically gives a taxpayer three to five years to pay off a balance once a California state income tax payment plan has been granted. I have installments set up for my federal taxes but I did not see an option for California state taxes. Free Competing Quotes From Tax Relief Consultants.

As an individual youll need to. Typically taxpayers are given three to five years by the state to pay off a balance once a California tax payment plan has. Get A Free Tax Relief Consultation To Eliminate Tax Debt.

For example the State of California Franchise Tax Board. Box 2952 Sacramento CA 95812-2952. Ad Dont Face the IRS Alone.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The average effective after exemptions property tax rate in california is 079 compared with a national average of. For example if you reported an outstanding tax bill on your 2019 tax return on July 15 2020 in most cases the IRS has until July 15 2030 to collect the tax from you.

Dont Let the IRS Intimidate You. Check or money order Mail your. An application fee of 34 will be added.

By completing Form FTB 3567 and sending it to the State of California Franchise Tax Board PO.

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

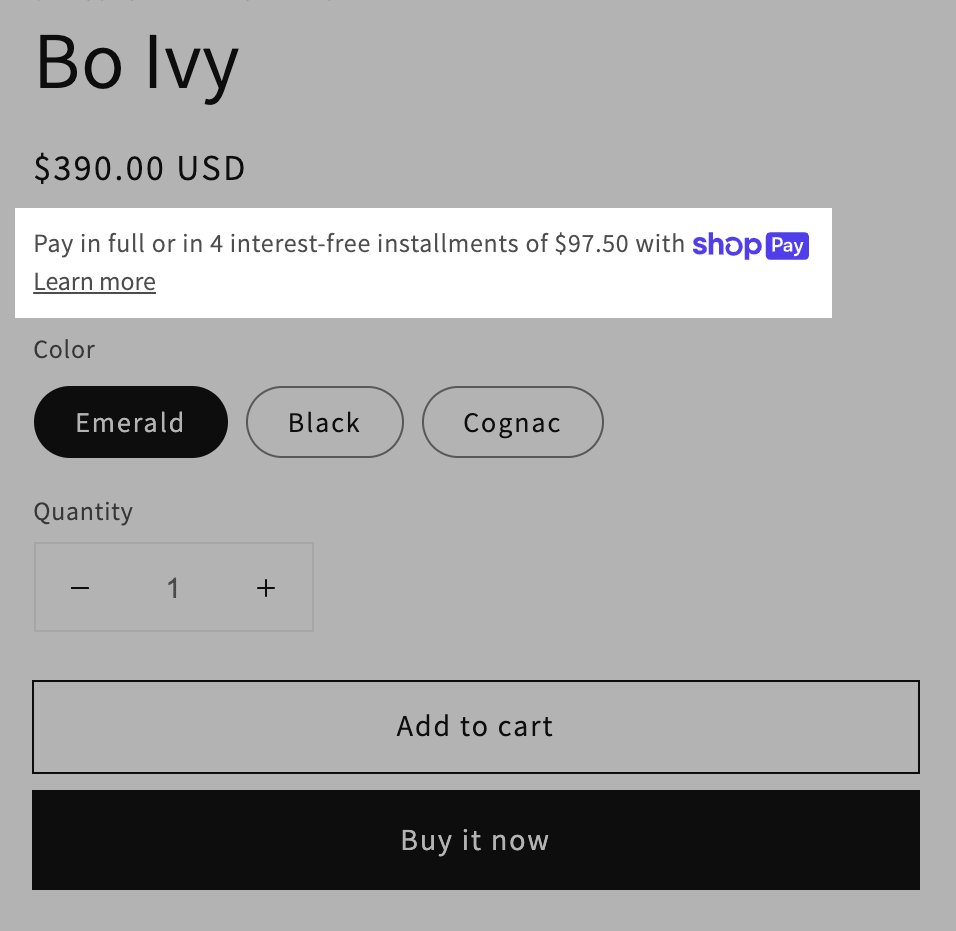

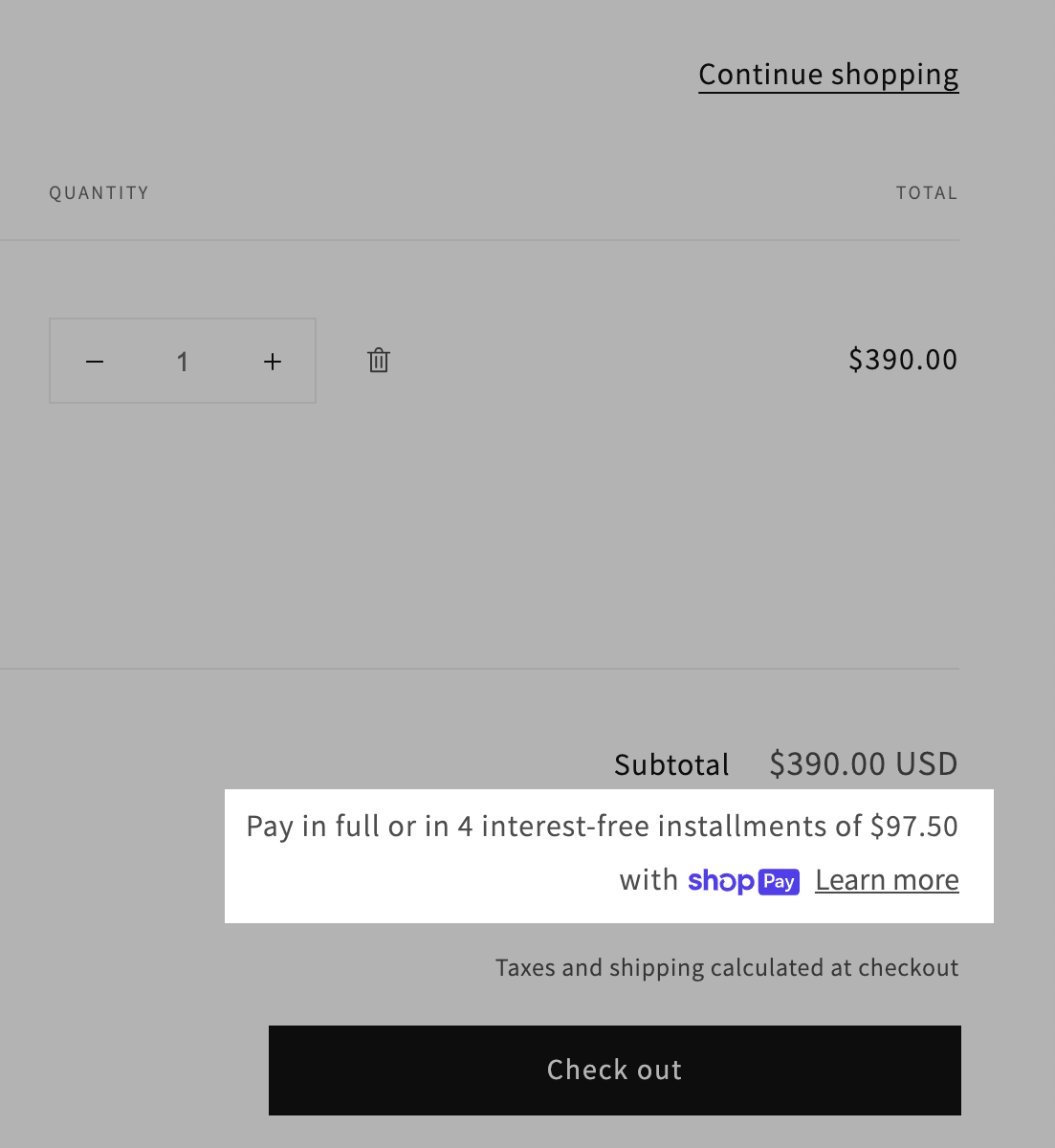

How Do I Pay Using Shop Pay Installments Luxy Hair Support

Lease And Buy Agreement Real Estate Forms Real Estate Real Estate Contract

Irs Notice Cp523 Intent To Terminate Your Installment Agreement H R Block

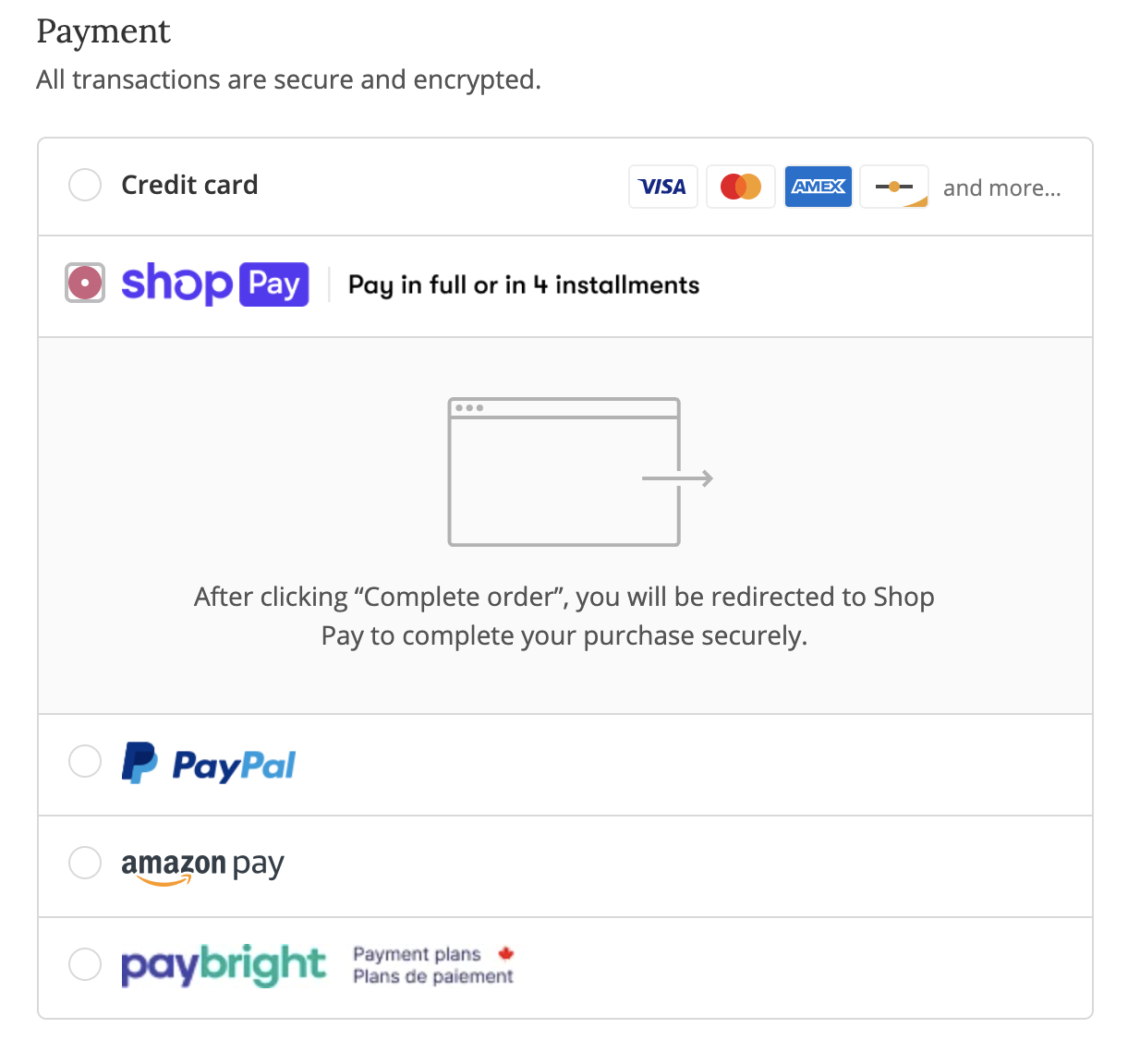

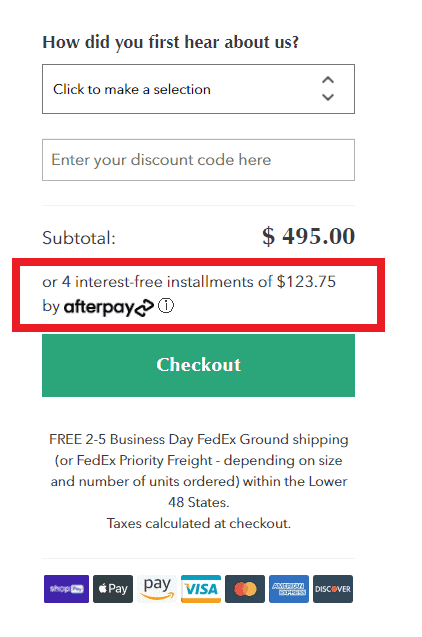

Buy Now Pay Later Options For Ecommerce Websites Inflow

Irs Letter 4458c Second Installment Agreement Skip H R Block

Shop Pay Installments Marzocchi

Secured Property Taxes Treasurer Tax Collector

:max_bytes(150000):strip_icc()/ScreenShot2021-02-10at11.00.22AM-1f51d54182cb40b0b110e0940688fbb8.png)

Form 6252 Installment Sale Income Definition

How Do I Use The Shop Pay Installments Feature To Pay For My Order Brooklyn Tweed

:max_bytes(150000):strip_icc()/9465-700bb91065234917b8d2866f2306afe9.jpg)

Form 9465 Installment Agreement Request Definition

Installment Agreement Request California Franchise Tax Board

When Does It Make Sense To Elect Out Of The Installment Method

Sample Commercial Rental Agreement Rental Agreement Templates Room Rental Agreement Commercial

Commercial Property Lease Agreement How To Create A Commercial Property Lease Agreement Download This C Lease Agreement Lease Agreement Free Printable Lease

How Do I Use The Shop Pay Installments Feature To Pay For My Order Brooklyn Tweed